Simplifying Interchange Fee Management

Scheme Audit Ready

Region-Wise Rules

Automated Fee Reports

Automate, audit, and analyze interchange and assessment fees with precision. Designed for issuers and acquirers to boost transparency and compliance.

Transparent Fee Management for Card Transactions

Analyze, Manage, and Control Interchange and Scheme Fees

Interchange and assessment fees are critical yet complex aspects of every card transaction. Our platform simplifies the process by automating fee generation, management, and auditing. Whether it’s issuer/acquirer-based fees or scheme assessments like VISA, MasterCard, or others—our system ensures transparency and accuracy. Region-wise configuration, RBI and global compliance, card-wise analysis, and robust reporting empower banks, PSPs, and merchants to monitor profitability and identify fee discrepancies with ease.

Built for Transparent Financial Governance

Interchange & Scheme Fee Processing Simplified

Our end-to-end solution allows financial institutions to set region-specific rules, schedule automatic audits, detect anomalies, and generate actionable reports. Stay compliant, improve financial efficiency, and unlock deeper insights into card-based fee structures.

Features

Flexible Pricing & Fee Governance

Automated Interchange & Assessment Fee Management

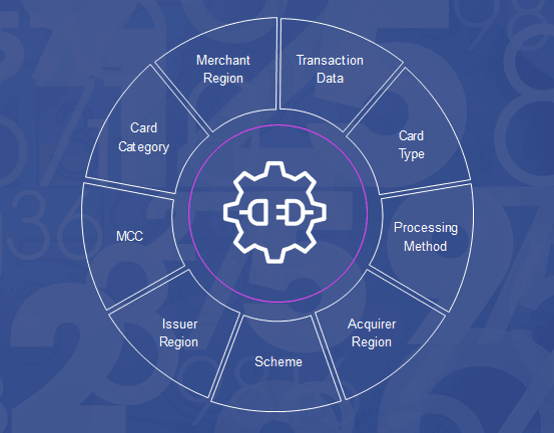

Our platform offers a powerful system to configure, generate, and reconcile interchange and assessment fees across schemes. Supporting both acquirer and issuer perspectives, it enables granular analysis at the card, MID, MCC, and transaction levels, ensuring compliance with domestic and global regulations.

Interchange Fee Intelligence

Automatically calculate, monitor, and audit interchange fees based on scheme, card type, MCC, and region. Enables transparency with expected vs actual fee reports, profitability analysis, and compliance tracking across countries and regulations like RBI mandates.

Assessment Fee Auditing

Generate and track fees billed by card schemes (VISA, MasterCard, etc.). Scheduled reporting supports daily to yearly cycles and highlights exceptions, violations, and cost discrepancies for proactive decision-making and cost recovery.

Custom Fee Reporting Suite

Gain access to dynamic reports—Ageing Analysis, POS Matrix, MCC/MID-wise breakdown, and EMV environment-based reports. Identify gaps in fee calculations and billing, and support accurate reconciliation and data-driven insights.

Over 30% Fees Go Unverified Monthly

Accuracy in Every Fee

Monitor, Reconcile, and Act Faster

Navigating intricate global/domestic fee structures demands sharp interchange/assessment management. Our platform delivers end-to-end control: generate, configure, audit all card transaction fees (EMV, MCC, scheme). Reconcile with clarity, pinpoint mismatches (expected vs. actual), identify high-interchange card types, and enable strategic pricing. Gain operational clarity, ditch unverified billing.