+(91)22 4090 5300, +(91)22 4090 6300

hello@insolutionglobal.com

14th Floor, RTech Park, Nirlon Knowledge Park, Western Express Highway, Goregaon, Mumbai - 400063

Subscribe to our newsletter

+(91)22 4090 5300, +(91)22 4090 6300

hello@insolutionglobal.com

14th Floor, RTech Park, Nirlon Knowledge Park, Western Express Highway, Goregaon, Mumbai - 400063

Subscribe to our newsletter

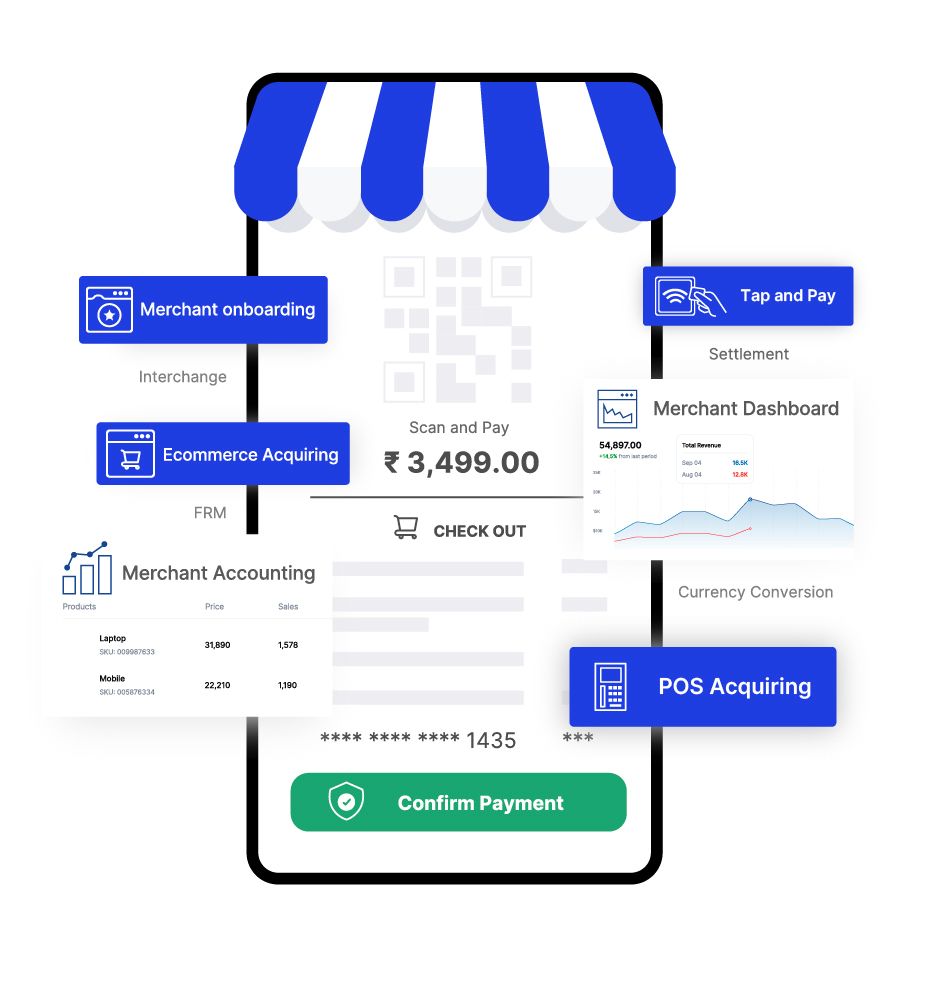

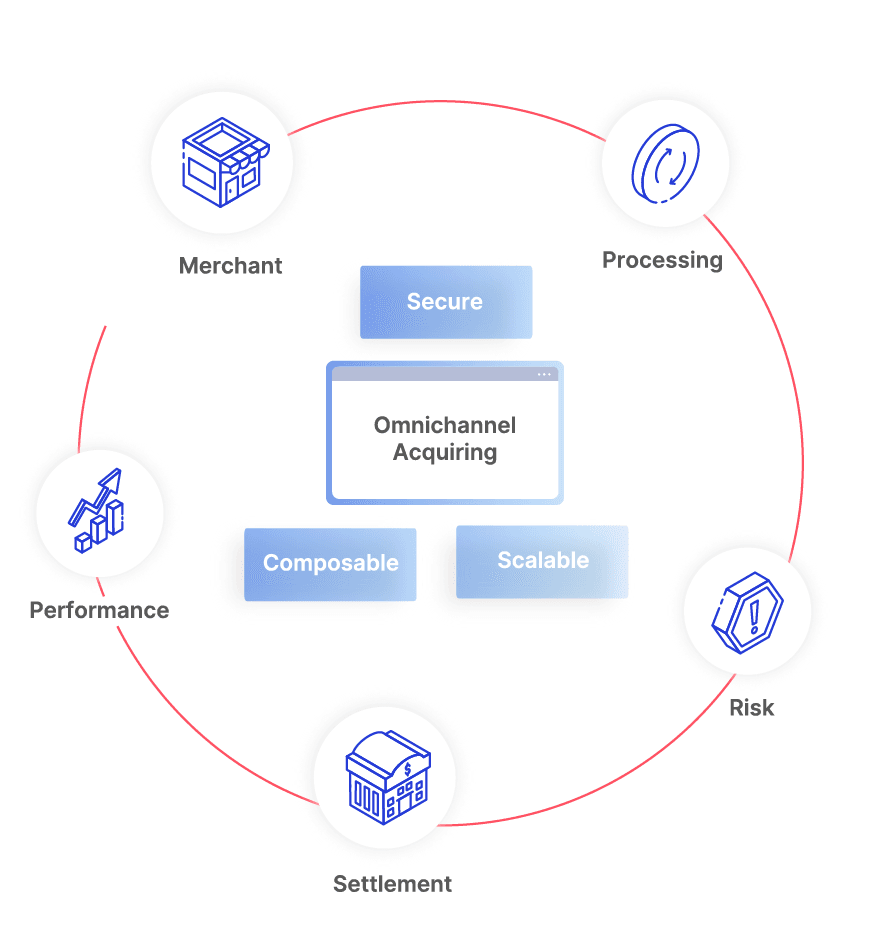

Omnichannel Acquiring

Scalable for All Business Models

Seamless Integration & Reporting

ISG’s omnichannel acquiring unifies digital and physical payments, offering secure, scalable solutions that simplify operations and enhance customer experience.

Delivering consistent, secure, and intelligent payment experiences across in-store, online, and mobile platforms. ISG's Omnichannel Acquiring solution empowers businesses with unified reporting, faster settlements, and reduced operational overhead—backed by a scalable, API-driven architecture.

Seamlessly designed to meet your payment processing needs, empowering informed decisions and optimising business operations.

Currencies Supported

ISG's Acquiring stack is live in APAC & ANZ

Up Time of Servers

Transactions/Second Supported

Simplify your digital payments infrastructure with advanced tools—ranging from risk engines and tokenization to transaction monitoring and dispute management—all accessible through one dashboard.

Whether you run a retail chain, a fintech startup, or a transit utility—ISG’s omnichannel acquiring solution is built to help you scale, stay compliant, and simplify your payment experience from one platform.

A robust and automated onboarding process for acquirers who work with merchants, to help them manage on-boarding to post-set up support.

Secure Contactless Payments

Comprehensive POS and merchant acquisition suite empowering banks with seamless processing, smart deployment, and scalable payment solutions.

ISG’s secure, scalable gateway enables fast transactions, instant refunds, smart fraud protection, and seamless integration across all payment modes.

Tap & Pay Made Easy | Smart, Secure & Affordable Payments for Every Business

Automate recurring payments with RBI e-mandates, smart billing models, and global multi-currency support—seamless revenue collection, simplified operations.

Effortless and Intelligent

Create Payment Links Instantly!

When a request for transaction authorization is sent, the authorization switch analyzes the details and identifies the financial institution servicing the card.

RBAC enhances security by protecting sensitive data, streamlines access management, & ensures compliance by assigning permissions to roles, not individuals.

KYC Solution for Issuers & Acquirers

ISG offers acquirers a pricing model for every scenario—CP or CNP, local or global—with the flexibility to align with merchant needs and business goals.

Automate, audit, and analyze interchange and assessment fees with precision. Designed for issuers and acquirers to boost transparency and compliance.

Acquiring services are crucial for handling financial transactions between the acquirers (the payment processors or banks) and the merchants.

FRM secures merchant payouts by monitoring the transactions for card schemes. It flags anomalies via risk rules, triggers alerts, and holds suspicious transactions.

Secure real-time payments with Genius eFRM. Detect fraud, prevent risks & ensure compliance with intelligent monitoring, agile rules & automated risk assessment.

The 3DS Server enables secure card-not-present transactions by verifying customer details, authenticating identity, and ensuring PCI DSS compliance to reduce fraud.

Simplify the complexity of interchange fees with real-time control, region-wise audit trails, and smart analytics—designed to protect your profitability.

In digital transactions, security is key. Tokenization replaces sensitive data with unique identifiers, reducing fraud risks and ensuring safer payments.

When a request for transaction authorization is sent, the authorization switch analyzes the details and identifies the financial institution servicing the card.

Customers can conveniently register disputes through various omni-channels: Mobile Banking, Internet Banking, Corporate website, IVRS, Email, & Branches.

BBPS, managed by NPCI, is a unified system for secure, seamless bill payments. In Solutions Global powers its API-driven architecture for banks, fintechs & billers.

Seamlessly designed to meet your payment processing needs, empowering informed decisions and optimizing business operations through a single, robust platform that supports all payment modes, channels, and merchant use cases.